Managerial finance is a course that enables students to make straightforward or tough decisions in the field of business. This subject involves decision-making and management of funds at the international level that does business at a great level. Many students studying this course find it difficult as they have to submit their case study analysis on financial management as a part of their academic program. It offers a conceptual and analytical framework for students. It contains the analysis of financial reports, balance sheets, and cash flow statements, which is not easy for students to get done without professional managerial finance case study help.

We at MyCaseStudyHelp.Com offer case study writing services to help those students who feel difficulty in making their assignments and who want their assignments done excellently within time. We are Australia’s leading company as students trust our assignment writing service. To help students, we have all subjects’ matters specialists.

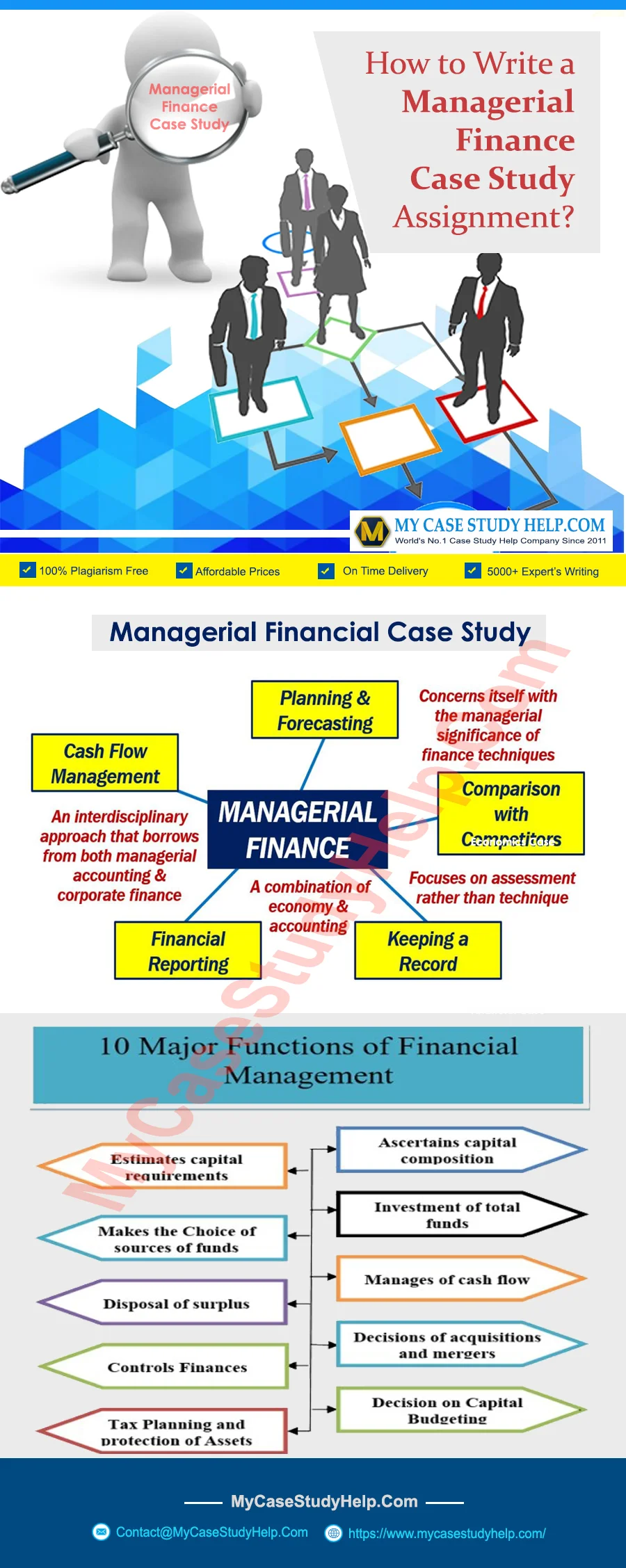

What does a managerial finance case study assignment mean?

Managerial finance is not only the study of exchanging or handling money, but it also includes the techniques to enhance and assign financial resources over a certain period. The management of finance is the arrangement of funds with a target to effectively and efficiently attain the organization’s desired objective. The primary purpose of preparing a financial case study assignment is to determine the organization’s financial position by calculating various ratios, including the impact of legal, political, economic, and tax changes on the organization’s financial statement. The other purpose of preparing this is to find out the stock market performance of the company.

Different kinds of decision making involved in managerial finance:

Decision-making helps in the proper managing of available financial resources for achieving the organization’s objective. There are four main kinds of managerial finance decisions that are:

- Working capital management decision

- Capital budgeting and long-term investment decision

- Dividend decision

- Capital structure or finance decision

Types of assignment categorized under managerial finance

Cash flow statement analysis: Cash flow analysis discusses how cash inflows and outflows during a particular period. It shows the different activities that the organization is involved in, such as operating, financial, and investing. This managerial assignment assists students in comprehending the cash position of the organization.

Analysis of balance sheet: Balance sheet analysis tells you about the financial position of an organization at the end of the financial year. This kind of does assignment help you understand how organizations all over the world use the balance sheet as a means to determine whether to invest or not, as it reflects what an enterprise owns and owes. It assesses and analyses the assets, liabilities, and equity of a company.

Recording and bookkeeping process: Recording and transactions help students know how the actual bookkeeping process occurs in any organization. It helps in getting knowledge about the mechanical process of recording sales, revenue, expense, and income documented in a proper place to ensure that the company has the correct financial statement at the right time.

Identifying the financial risk: Financial risk analysis helps you understand all the risks an organization can face that involve the monetary aspects. The financial risk is termed as the possibility of monetary loss to the shareholders. It also indicates that the bondholders may lose money if the government defaults on its bonds. Financial risks comprise credit risk, asset-backed risk, liquidity risk, equity risk, foreign investment risk, and currency risk.

Analyzing financial reports: Financial reports analysis shows you how the financial reports of any organization are evaluated and then analyzed. It assists you in knowing the process of reviewing the organization’s financial statement like profit and loss statement and balance sheet. This kind of case study helps the students understand the company’s financial condition and how to make effective decision making in an organization by using this technique of financial management.

Importance of managerial finance case study help

The managerial finance case study helps to improve the financial condition of any organization. The financial data shows the precise outcomes of a company’s structure and strategy. A company’s financial position can be ensured by ratio analysis. The financial performance ratio can be calculated from the income statement and balance sheet. It can be categorized into five subgroups: profit ratio, activity ratio, monetary ratio, shareholder return ratio, and leverage ratio. This ratio can be differentiated with industries averages or previous years of company performance.