Investment Analysis refers to the different methods of evaluating an investment, economic trends, and industry sectors. It contains charting past returns to predict future performance, choosing the type of investment that best suits an investor’s requirements, or analyzing individual securities such as bonds and stocks to determine their risks, yield potential, or price movements. Students in finance management have to learn different investment analysis and management aspects. They learn different investment analysis methods and how to apply them in real-world situations. The majority of the students pursuing management courses need expert assistance in Investment Analysis Case Study Assignment.

We at MyCaseStudyHelp.Com have formed Investment Analysis Case Study writing assistance easing your writing tasks. We aim to help you with all sorts of professional assistant that you desire while writing an Assignment so that you don’t get burdened at any moment. As a student in finance, you should know the difficulty level of these topics and corresponding assignments, but when you get our assistance, all your problem is solved easily and efficiently.

Understanding The Investment Analysis Case Study Assignment

The objective of investment analysis is to determine the performance of investment and its suitability for a particular investor. Commonly investment analysis is termed as the technique of evaluating the vitality of an investment. While performing an investment analysis case study assignment, your job is to analyze the positive and negative aspects of the concerned investment, its profitability, future risks factors, and whether that would be an effective investment for the portfolio. Key factors in investment analysis consist of the reasonable entry price, the expected time horizon for holding an investment, the role that the investment will play in the portfolio as a whole.

In performing the investment analysis of a mutual fund, for instance, an investor looks at how the funds performed over time compared to its benchmark and its main competitors. Peer fund comparison consists of investigating the differences in performance, management stability, expense ratio, investment style, sector weighting, and asset allocation.

Types of Investment Analysis

Investment analysis can be divided into various basic approaches. Here, we are discussing and comparing the set of two different approaches of analysis:

- Top-Down vs. Bottom-Up

- Fundamental vs. Technical Analysis

Top-Down vs. Bottom-Up

The top-down approach starts with the analysis of economic, industry trends, and market before zeroing in on the investment that will benefit from those trends. The global and macroeconomic approach is a hallmark of top-down investment analysis.

For instance: In a top-down approach, an investor might investigate several sectors before making the final decisions. The investigation is focused on the financial performance that should be performing better than industrials. As a result, investors decide the investment portfolio will be underweight industrials and overweight financials.

The bottom-up analysis does not focus on market or economic cycles. Instead, it aims to find the top companies and stocks regardless of the overarching trend. It takes a microeconomic approach to investigate rather than a macroeconomic approach.

For instance: The other one is a bottom-up method, where an investor may observe that an industrial company made for effective investment and invested a significant sum of capital to it even the outlook for the larger industry was relatively negative.

Fundamental vs. Technical Analysis

The fundamental analyst emphasizes the financial health of companies and the broader economic outlook. Fundamental analyst practitioners want stocks they believe that the market has mispriced. That is, they trade at a price lesser than is warranted by their intrinsic value.

The technical analysts assess patterns of statistical parameters and stock prices using computer-calculated charts and graphs. Technical analysts focus on patterns of price movement, trading signals, and other different charting tools to evaluate a security’s strengths and weaknesses.

Look At The Different Aspects of Investment

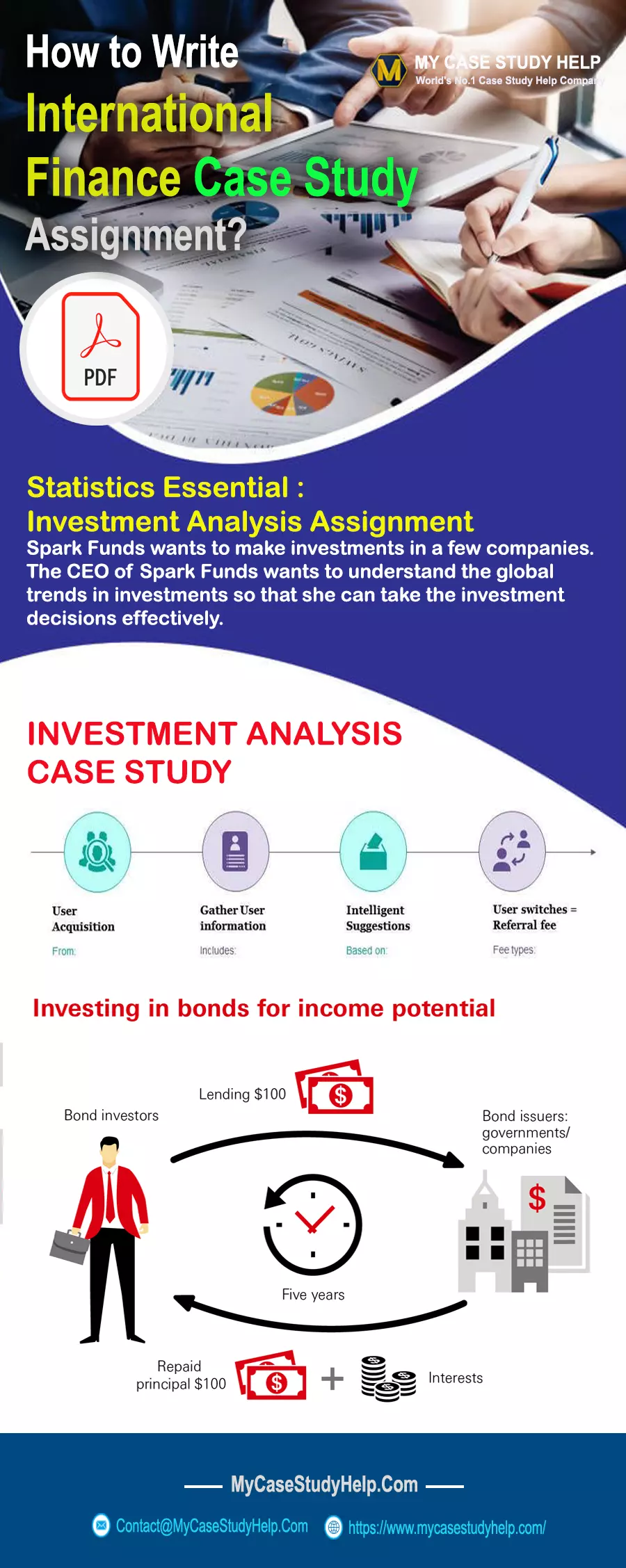

Cash flows in an investment: Cash flow is quite common and expected in investment. Cash flow can happen in numerous ways like interest payment, bonus payment, dividend, etc. Cash flow in investment is significant because, through this process, the investor gets back the allocated amount. Besides the repayment of the invested amount, investment analysis also shows whether the investment gives enough cash flow for compensating the risk taken or not.

The risk involved in an investment: Evaluation of risk factors and their effect is crucial in any type of investment. If the risk factors are very damaging, the experts advise accordingly to manage the investment in a specific way that can reduce the risk.

The resale value of an investment: When the investment is made on the asset, and when it is sold after some specific period generating any profit, then it is said that the current investment is an ideal one. In investment analysis, the resale value of the current investment is significant. An investment is not ideal when it does not create any attractive resale value.